Chapter 13: Industries and Services

13.5 Industrial Changes in the Steel Industry

13.5.1 Overview of The US Steel Industry

Source: Photo by John Mudd via Cornell University Library Kheel Center, CC BY 2.0

Historically, steel production benefited greatly from significant economies of scale: the larger the blast furnaces, and the greater the number of Bessemer converters (see Figure 13.5.2) and open hearth furnaces in operation, the lower the cost of steel production. Due to the substantial fixed costs associated with these facilities, producers were motivated to maximize their utilization, often reducing prices to just above the marginal cost of production during periods of low demand. This resulted in chronic overcapacity as steelmakers continually expanded their facilities and engaged in price competition with each other. By the end of the 19th century, nearly half of the steelmaking capacity in the US remained unused each year.

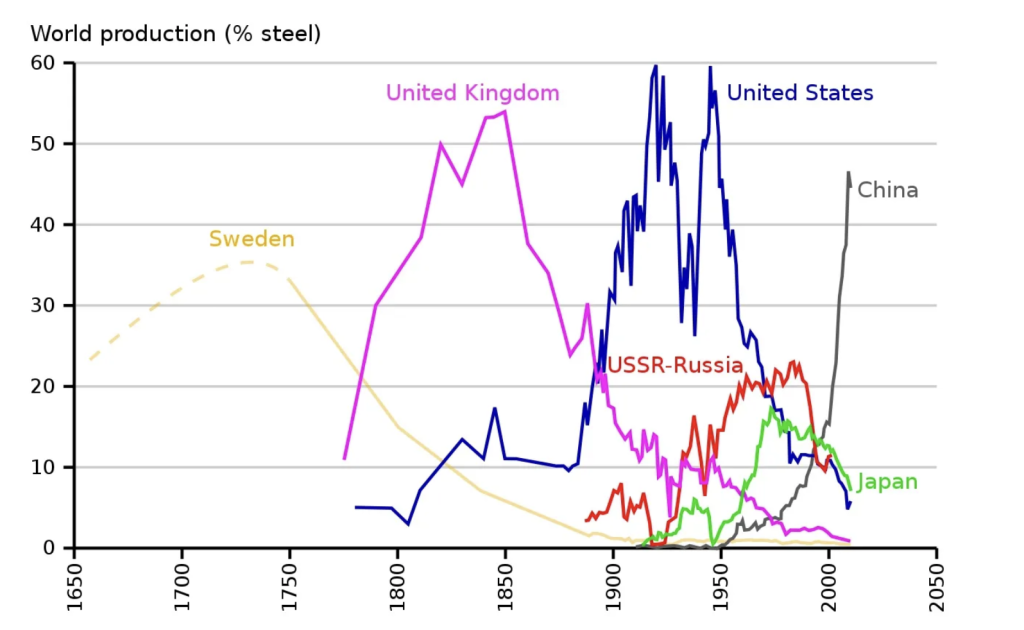

By the end of World War II, the American steel industry stood unrivaled. During the war, American steel production surged by more than a third, whereas the steel industries of many other countries were severely crippled. By 1945, the United States accounted for over 60% of global steel production. American steelmakers possessed cutting-edge technology, unmatched expertise, the largest economies of scale, and abundant access to resources like iron ore and coal. However, the American steel company neglected to invest in newer technology as their equipment had many years of production left.

Thus, by the early 1960s, cracks began to appear in America’s once-dominant steel industry. Foreign producers, particularly from Japan, had expanded their industries and adopted advanced steelmaking technologies such as the BOF and continuous casting. Meanwhile, American steelmakers like US Steel, burdened by outdated technology and high labor costs, faced competitive pressures from abroad for the first time. As early as 1958, steelmakers in Germany and Japan were able to compete with US producers on price.

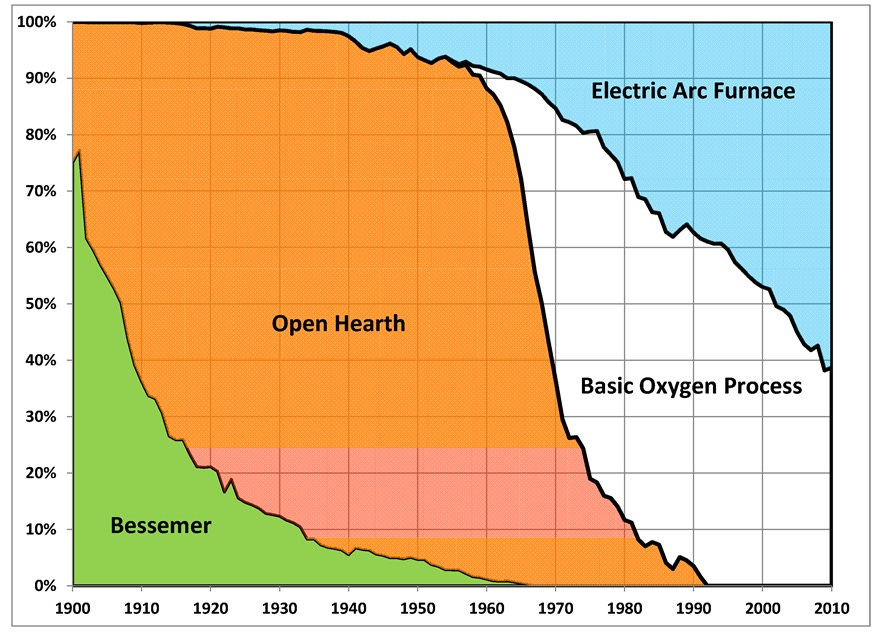

There are essentially two primary methods for producing steel products: the integrated mill and the mini-mill. In an integrated mill, steel is made directly from iron ore, whereas in a mini-mill, steel is produced by melting down existing pieces of steel or iron. Over the years, integrated mills have employed various technologies, with a significant modern advancement being the shift from open-hearth furnaces to the basic-oxygen process. The basic-oxygen process, named for its use of alkaline chemicals, can produce steel approximately 15 times faster than an open-hearth furnace.

13.5.2 The Rise of the Mini-Mills

Mini-mills utilize electric arc furnaces, which are even more efficient. These furnaces are more productive partly because they require fewer chemical steps and can be turned on and off quickly.

Increasing productivity in the steel industry over the past hal

Source: “US Steelmaking Process Percentages 1950-2012” by Plazak via Wikimedia Commons is licensed under CC BY-SA 4.0.

f-century has largely involved either switching from open-hearth furnaces to the basic-oxygen process or transitioning to the mini-mill business model, which relies on electric arc furnaces. The United States has implemented both changes: the shift to the basic-oxygen process occurred rapidly in the 1970s, while the transition to mini-mills has been more gradual (see Figure 13.5.2).

U.S. firms were often pioneers in adopting the technologies that now dominate global steel production. However, they did not implement these technologies as swiftly or extensively as their Japanese and other foreign competitors. Under growing pressure from imports and unionized labor, U.S. integrated producers reduced investments in new plants and equipment. In contrast, Japanese producers embraced and rapidly implemented new steel production technologies in increasingly large facilities.

A significant part of this technological advancement in the 1960s and 1970s involved the adoption of the basic-oxygen process, as detailed by Kobayashi (2023).

Japanese companies, driven by a booming economy and high growth rates, were keen to invest in new technologies. In contrast, American producers avoided the fixed costs associated with these innovations, focusing instead on short-term cost-cutting at the expense of long-term competitiveness. This slow adoption of new technology contributed to the sharp but temporary decline in U.S. steel exports during the 1970s and early 1980s.

The situation began to improve in the 1980s when the U.S. significantly increased the use of mini-mills, which employ electric arc furnaces to convert scrap into new steel products. Lieberman and Johnson demonstrate that Nucor, a U.S. steel producer specializing in mini-mills, achieved total factor productivity (TFP) levels surpassing those of Japanese producers. A Brookings report indicates that U.S. steelmaking TFP outpaced Japan’s in the 1990s and 2000s.

Collard-Wexler and De Loecker (2015) provide an excellent analysis of how the adoption of mini-mill technology led to substantial gains in TFP for the U.S. steel industry. They state:

The increase in productivity can be directly linked to the introduction of a new production technology, the steel minimill. The minimill displaced the older technology, called vertically integrated production, and this reallocation of output was responsible for about a third of the increase in the industry’s total factor productivity. In addition, minimills’ productivity steadily increased. We can directly attribute almost half of the aggregate productivity growth in steel to the entry of this new technology.

Mini-mills not only boosted productivity directly but also heightened competition within the steel industry. This competition forced uncompetitive old steel companies out of business and compelled the best integrated producers to improve their performance.

13.5.3 The State of Steel Production

Global steel production has more than tripled over the past 50 years, even as countries like the U.S. and Russia have reduced their domestic production and increased their reliance on imports. In contrast, China and India have steadily increased their production, becoming the world’s top two steel-producing nations.

China now produces the majority of the world’s steel, realizing Mao Zedong’s long-standing ambition. It might be tempting to interpret this trend as evidence that China has become the U.S.’ factory and that the U.S. steel industry has been decimated by a flood of cheap Chinese imports.

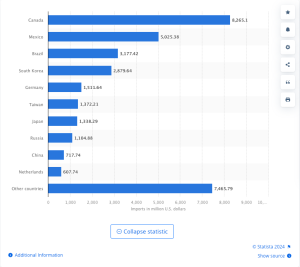

Source: “Imports for consumption of steel products into the U.S. in 2021, by origin(in million U.S. dollars)” copyrighted by Statista

However, this interpretation is incorrect. The significant decline in U.S. steel production occurred in the 1970s, a period when Chinese production was minimal. Furthermore, the U.S. imports very little steel from China; its largest foreign suppliers are Canada and Mexico, with China playing only a minor role.

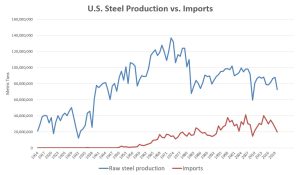

Despite significant improvements, U.S. total steel production did not increase in the 2000s. However, exports did rise, as domestic steel usage declined. The enhanced competitiveness and productivity led to higher exports rather than increased overall production.

The core reason for the decline of the U.S. steel industry is straightforward: the U.S. stopped consuming steel. Consequently, domestic steel production decreased because demand fell. Unlike some economic mysteries, such as the persistently high cost of groceries, the relationship between U.S. steel production and consumption is clear. Historically, these two factors have been closely correlated, and this trend continues today.

Source: “U.S Steel Production vs. Consumption (Source: USGS)” retrieved from Noah Smith. (2023, December 22.) Why the U.S. steel industry is dying. Noahpinion.

13.5.4 Steel Consuming Industries

Who uses steel? Steel products are primarily intermediate goods, meaning they are mainly purchased by industries as inputs for production rather than by individual consumers. The construction industry is the largest consumer of steel, using about 50% of global production for buildings, highways, railroads, and other infrastructure. The automotive manufacturing and mechanical equipment sectors are also major consumers, accounting for around 30% of steel usage. Metal products and transportation sectors together make up about 17% of steel consumption.

Various sources for different countries and time periods may show slightly different proportions, but they all convey the same message: buildings, infrastructure, cars, and machinery drive steel demand.

Source: “Evolution production acier pays” by Borvan53 via Wikimedia Commons is licensed under CC BY-SA 4.0.

China’s massive steel production is primarily due to its extensive building boom—constructing numerous apartments, offices, highways, train networks, and large factories. Additionally, China has been heavily involved in manufacturing, producing vast amounts of vehicles and machinery. Remarkably, in the 2010s, China used as much cement every few years as the U.S. did throughout the entire 20th century. Steel consumption followed a similar trend. However, China’s steel surge is not unprecedented when compared to global production. In earlier eras, both the UK and the U.S. were even more dominant in steelmaking as it coincided with the building of railroads, cities and highways.